Aug 03 ‘23

29 min read

Acquiring a business has the potential to transform and expand a company rapidly. However, selecting the wrong target wastes time, resources, and distractions. To avoid such pitfalls, you must conduct a thorough analysis, investigation, and due diligence.

To assist in making an informed decision, we have created a business due diligence checklist with the questions to ask when buying a business.

So, what areas need assessment during business due diligence? Let’s find out.

Vital due diligence questions to ask when buying a business

When conducting due diligence, it’s crucial to tailor the questions to the specific transaction and the practices of both parties involved. As a buyer, you should begin by defining your goals, values, and strategies to guide due diligence effectively. Next, adopt a structured approach to asking due diligence questions.

Although there is no universal template, several critical areas must be thoroughly examined. Please note that these questions should be tailored to the specific industry and nature of the acquired company to ensure relevance and depth in the diligence checklist:

- Questions to ask during due diligence: company information

- Key due diligence questions: financial statements

- Due diligence question list: services and products

- Due diligence questions when buying a business: intellectual property

- Questions about customers of an acquired company

- Questions about employees

- Questions about technology assets

- Questions about the legal state of an acquired company

Questions to ask during due diligence: company information

- Can you provide a comprehensive overview of the company’s organizational structure, including company ownership information overview, subsidiaries, joint venture relationships, and affiliated entities the company owns?

- What is the company’s core business model, and how does it generate revenue and maintain cash flow?

- Are there any ongoing legal disputes or regulatory investigations involving the company? If yes, what is their current status and potential financial implications?

- How does the company handle security agreements and protect sensitive customer data and other proprietary information? Has the target business experienced any security incidents or significant data breaches?

- What is the company’s competitive positioning and market share within its industry?

- Can you provide a detailed analysis of the company’s customer base, including key clients and any significant customer concentration risks?

- What are the company’s major customers, partnerships, and key supplier relationships? Are there any upcoming contract renewals or potential alterations that might impact business?

- What are the key factors influencing profitability and growth?

- What are the company’s major assets, such as intellectual property, patents, trademarks, or proprietary technologies? Are there any pending disputes or licensing agreements related to these assets?

- Has the company undergone any significant management changes, experienced high employee turnover recently, or had major customers lost? If so, what were the reasons for these alterations?

Tip: Due diligence is commonly conducted either by the buy- or the sell-side. Check out this buy-side due diligence checklist example.

Key due diligence questions: financial statements

- What is the company’s revenue trend over the past five years, and what factors contributed to any significant fluctuations?

- Is it possible to provide a breakdown of the company’s financial information and identify any areas that have experienced substantial cost increases?

- What are the company’s current debt and outstanding liabilities, including loan agreements, supply agreements, bonds, and other bank financing arrangements?

- How does the company handle its accounts receivable, and what are the key metrics for assessing the effectiveness of its collections process?

- Can you present an in-depth analysis of the company’s cash flow, i.e., operating, investing, and financing activities?

- What are the company’s major assets, and how are they valued on the financial statements? Are there any intangible assets?

- Has the company undergone any significant changes in its accounting policies or practices recently? If it has, what were the reasons for these adjustments?

- How do you manage the inventory the company owns, and are there any indications of slow-moving or obsolete stock?

- What are the company’s major sources of funding, and what are the terms and conditions of any outstanding loans or credit facilities? Can you provide the company’s credit report?

- Are there any contingent liabilities or potential legal risks that could impact the company’s financial position? Could you prepare the company’s insurance claims history?

Due diligence question list: services and products

- Can you provide a detailed catalog of the company’s products and services, along with their respective sales volumes and revenue contribution?

- What are the key features and unique selling points of the company’s provided products and services, and how are they different from those of competitors?

- Are there any pending or historical product recalls or safety issues related to the company’s offerings? If so, how were they addressed, and what were the consequences?

- How does the company handle customer complaints and feedback, and what is the overall customer satisfaction level with its products and services?

- Can you provide information on the company’s research and development efforts, including any ongoing projects, new product launches, or pending patents?

- What is the product/service lifecycle for the company’s offerings, and are there any products or services that are nearing obsolescence or reaching maturity?

- How does the company manage its supply chain and vendor relationships to ensure the quality and timely delivery of products and services?

- Are there any existing agreements or contracts with key customers, suppliers, or distributors that need to be reviewed in the context of the acquisition?

- What is the geographic reach of the company’s products and services, and are there any specific regulatory or compliance issues related to different markets?

- Can you show an overview of the company’s pricing strategy and how it is different from the strategies of industry peers? Are there any recent price adjustments or discounting practices that may impact profitability?

Due diligence questions when buying a business: intellectual property

- Does the company possess or have licenses for all the rights necessary to manufacture, utilize, sell, or offer for sale its proposed products?

- Are there any significant gaps or defects in patent coverage for the target business products and services?

- Has the determination of inventorship been completed, and have assignments been filed for patents owned or licensed by the company? Have any disagreements arisen concerning inventorship or ownership of the company’s intellectual property? Is there any IP that is co-owned with another entity?

- Has the company performed a freedom-to-operate search? Have either internal legal experts or external counsel conducted further reviews of patents? Has the company obtained a freedom-to-operate opinion?

- Has the company received any letters suggesting the need for licenses to third-party IPs? Has there been any other correspondence threatening IP disputes?

- Are there any open-source software components or third-party intellectual property integrated into the target company’s products, and how are these licensed?

- Have any inventors exited the company, and was their departure on good terms? Do all of the employees sign employment agreements assigning their IP?

- What intellectual property has the company acquired through in-licensing? Are there any other entities that also possess licenses or rights to utilize this IP? What is the field of use? What out-licenses has the company granted?

- Do the company’s standard vendor agreements include provisions for IP ownership by the company?

- Are any of the company’s trademarks currently facing threats or opposition in legal or administrative proceedings?

Questions about customers of an acquired company

- Can you provide a breakdown of the customer base by geographic region, industry, and size (e.g., small businesses, mid-market, enterprise)?

- Which customers contribute the most to the company’s revenue, and what proportion of the total revenue do they account for?

- Are there any long-standing customer relationships vital to the success of the target business? How has the company maintained and nurtured these relationships over time?

- What is the customer retention rate, and has there been any recent significant churn or loss of key customers?

- Are there any contractual commitments or service-level agreements with customers that need to be reviewed for potential risks or obligations?

- Can you provide an analysis of the company’s customer satisfaction surveys and feedback to gauge overall customer sentiment?

- How does the company acquire new customers, and what is the effectiveness of its marketing and sales strategies?

- Are there any concentration risks in the customer base, such as relying heavily on a few large customers for a significant part of revenue?

- Has the company faced any significant customer complaints, disputes, or legal issues related to its products or services? If so, how were they resolved?

- Can you provide insights into the company’s customer demographics and purchasing behavior to identify potential growth opportunities or areas of improvement?

Questions about employees

- Can you provide an overview of the target company’s organizational structure, including the number of employees, their roles, and reporting lines?

- What is the average tenure of employees at the target company, and what is the turnover rate in the past few years?

- Are there any key employees whose departure could significantly impact the company’s operations?

- What is the target company’s approach to employee development, training, and talent retention?

- Can you provide information about the target company’s employee benefits packages, including health insurance, retirement plans, and other incentives? Can you provide employee health and welfare insurance policies that are in place in your company?

- Are there any labor union agreements or collective bargaining agreements in place, and what has been the history of labor relations at the target company?

- How does the target company handle performance evaluations and promotions? Is there a clear career development path for all the employees?

- Are there any ongoing legal disputes or labor-related issues involving the target company and its employees?

- Can you provide insight into the target company’s workplace culture, employee satisfaction surveys, and measures taken to ensure a positive work environment?

- What is the target company’s approach to inclusion, equity, and diversity in its workforce, and how does it foster a diverse and inclusive workplace?

Questions about technology assets

- What are the key technology assets owned by the company, such as software applications, proprietary technologies, and hardware?

- Are there any pending or ongoing legal disputes or intellectual property challenges related to the company’s technology assets?

- Can you provide a comprehensive list of patents, trademarks, and copyrights held by the company, along with their current status and expiration dates?

- How does the company protect its technology assets, including data security measures, access controls, and disaster recovery plans?

- What is the condition of the company’s IT infrastructure, and has there been any recent investment in upgrading or maintaining the technology stack?

- Are there any licensed or third-party technologies integrated into the company’s products or services? If so, are there any concerns about license compliance or contract terms?

- Can you provide details about any ongoing research and development initiatives or innovation projects related to the technology assets?

- What is the level of technical debt within the company’s technology assets, and are there any known issues or areas that require immediate attention?

- Has the company experienced any major cybersecurity incidents or data breaches in the past? If so, how were these incidents handled, and what steps were taken to ensure they do not happen again?

- Can you provide an overview of the company’s technology team, including their qualifications, experience, and responsibilities?

Questions about the legal state of an acquired company

- Are there any ongoing regulatory investigations or legal disputes involving the target business? If yes, what are the details, potential liabilities, and expected outcomes?

- Has the company been involved in any past legal actions or settlements that could have ongoing implications or unresolved matters?

- Can you provide an overview of the company’s compliance with local, national, and international laws, regulations, and industry standards relevant to its operations?

- What is the current situation regarding the company’s contracts and arrangements with suppliers, customers, and partners? Are there any potential legal risks or obligations associated with these contracts?

- Does the company have any outstanding tax liabilities or audits, and has it complied with all tax regulations in the jurisdictions where it operates?

- Can you provide information about the company’s intellectual property portfolio and any legal actions or challenges related to patents, trademarks, or copyrights?

- Are there any environmental issues or regulatory compliance concerns associated with the company’s operations, particularly if it operates in industries with significant environmental impact?

- Has the company been subject to any sanctions, fines, or penalties imposed by regulatory authorities or government agencies?

- What is the status of the company’s corporate governance and compliance programs, including policies related to ethics, anti-corruption, and data privacy?

- Are there any material contracts or legal agreements that may have restrictions or conditions that need to be considered during the acquisition process?

The due diligence checklist is far from complete and needs to be adjusted to your industry and business specification. Apart from creating acquisition due diligence questionnaires, our experts have come up with some other things you can do to ensure a successful merger.

Due diligence questions to ask when investing in a business: final list

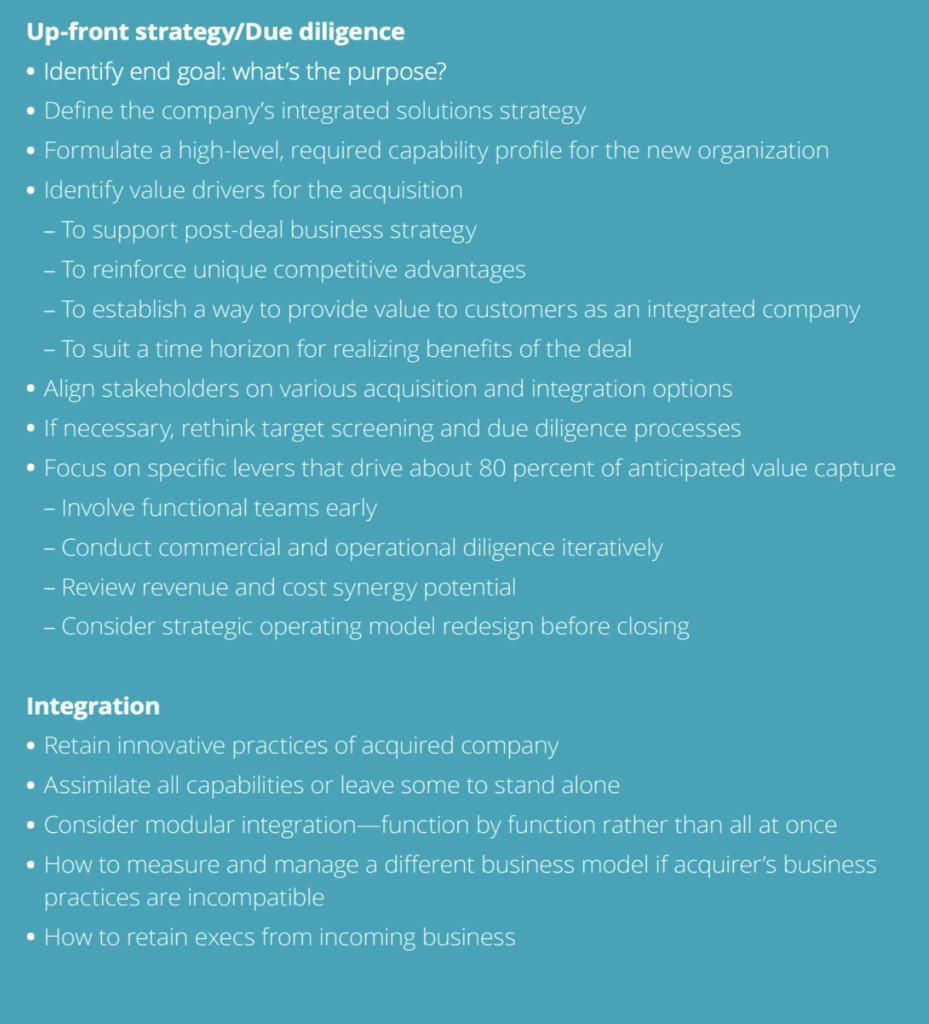

While numerous mergers and acquisitions fall short of expectations, you can enhance your prospects of success by employing the following checklist, created by Deloitte experts. This checklist focuses on upfront strategy and due diligence, as well as integration considerations:

| Post-merger integration is as essential as the merger itself. Check out this detailed post-merger integration checklist. |

Final Thoughts

Navigating the intricate landscape of acquiring a business requires a strategic and well-structured approach. This due diligence checklist serves as an essential guide to uncovering the potential and pitfalls of a target company. By thoroughly examining financials, legal standings, commercial positioning, operations, human resources, and asking the right questions, acquirers can make well-informed and confident decisions. Success in acquisition not only depends on the answers obtained but the quality of questions asked.

Utilize this checklist to ensure a comprehensive assessment and make your next business acquisition a triumphant one!