Jan 10 ‘24

21 min read

According to a survey, almost 60% of deals fail because of poor due diligence that didn’t identify critical issues. As the psychoanalyst James Hollis put it, “Hubris, or the fantasy that we know enough to know enough, seduces us toward choices that lead to unintended consequences.”

Thorough due diligence is indeed an extremely time- and effort-consuming process. Therefore, there might be a temptation to rush through it. However, having proper tools can significantly simplify and make it more efficient.

The article describes tools and strategies for the commercial due diligence process, which has gained popularity due to the growing complexity of the products and services in the market today.

What is commercial due diligence?

Commercial due diligence (CDD) is the evaluation of a target company’s commercial viability before making an investment decision.

The primary objective of CDD is to provide a prospective buyer with a deeper understanding of synergy and value creation potential, as well as possible risks or problems that may come up in an investment opportunity.

The commercial due diligence framework thoroughly analyzes a target company’s market position, industry dynamics, financial performance, competitive landscape, customer base, and legal risks.

This CDD process is a critical part of the decision-making process in mergers, acquisitions, and investments for several reasons:

- Risk assessment. Commercial due diligence is a risk assessment tool that helps investors minimize the likelihood of unexpected challenges and mitigate potential risks associated with the investment.

- Informed investment decisions. Commercial due diligence involves a thorough investment appraisal, ensuring that investors have a clear picture of the potential success and profitability of the investment.

- Value assessment. A thorough financial review of a target helps to determine the true value of the investment and potential returns.

- Strategic fit analysis. Commercial due diligence helps to understand how the acquisition aligns with the acquirer’s goals, objectives, and overall business plan and strategy.

| 📌 Are you considering an investment in startups? Read our article about conducting startup due diligence to maximize your investment potential. |

The commercial due diligence checklist

A commercial due diligence checklist is a tool that buyers can use for a comprehensive assessment of acquisition targets’ commercial aspects. It outlines the key areas to review and analyze and ensures a structured and systematic approach.

Drawing on our own experience, we have created a detailed commercial due diligence checklist that you can use as a framework during M&A, investments, or other business transactions.

| Due diligence aspect | Aim | Points to review |

| Market analysis |

To develop a clear understanding of the market dynamics, assess the target’s position within the industry, and identify growth opportunities or challenges. |

✔️ Market size |

| Customer analysis |

To evaluate the strength of the target’s market position based on its relationship with clients. |

✔️ Customer segmentation |

| Competitive analysis |

To analyze the target’s competitive position and to identify threats or opportunities arising from the competitive dynamics. |

✔️ Key competitors |

| Financial analysis |

To examine the financial metrics and evaluate performance to determine the target’s growth potential and its fair value. It will, in turn, help negotiate a more favorable deal. |

✔️ Financial statements |

| Operational analysis |

To gain valuable insights into operational inefficiencies or bottlenecks that may impact the target’s ability to deliver products or services. Also, to evaluate scalability for future growth. |

✔️ Production processes |

| Sales and marketing analysis |

To gain a deep understanding of the target’s sales and marketing strategies to understand the target’s ability to generate and sustain revenue growth. |

✔️ Sales and marketing strategies |

The checklist offers a basic framework and can be tailored to fit different industries and transaction types.

| Further reading: Explore our operations due diligence checklist and real estate due diligence checklist for additional insights. |

Strategies to excel in commercial due diligence

Based on our experience and the experience of other companies, we have detailed strategies to follow during the due diligence commercial process.

1. Seek advisory services

It’s extremely important to seek guidance from industry experts and financial advisors during due diligence. Moreover, it’s just as important to listen to what experts say and trust their opinions. The story of HA-LO Industries is a good example that demonstrates what can happen if doing otherwise.

When HA-LO Industries, a promotional products company, decided to buy the online promotional goods seller Starbelly.com, it hired an investment banker to look at the cash growth projections for the transaction. The banker then told HA-LO’s CEO that they were “wholly speculative.” The CEO ignored the information and bought the business for $240 million — within a year, the company went bankrupt.

2. Allocate sufficient time for thorough due diligence

Commercial diligence can take a few weeks to several months, depending on the deal’s complexity. What’s important is to not underestimate the time required to conduct it.

Let’s take the example of Hewlett-Packard. Its due diligence on the finances of the British software company Autonomy lasted only about six hours. The defense’s submission later said: “The due diligence of Autonomy’s finances was limited and largely consisted of four conference calls lasting approximately 1 to 1,5 hours.” A £8 billion deal ended in disaster and a $5 billion fraud case.

3. Create a comprehensive due diligence report

A due diligence report is a document that outlines the findings and analysis conducted during the due diligence process. Creating a report is extremely important as it acts like a detailed map that helps stakeholders understand the ins and outs of a business, which should ultimately lead to a good investment decision.

A proper commercial due diligence report should be comprehensive and contain details about the target’s operations, financial health, market position, and competitive positioning. It should also provide actionable recommendations to help with the decision-making. Read our article on how to create a due diligence report for more insights.

4. Leverage technology

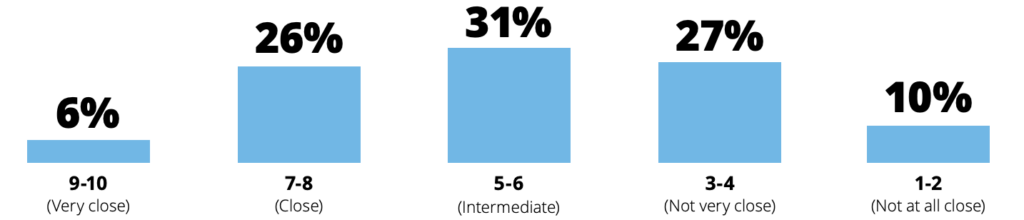

Today, technology solutions offer vast possibilities for streamlining and improving business processes. However, according to a survey, only 26% and 6% of global business leaders say their companies are close or very close, respectively, to utilizing technologies to improve processes.

That’s why, when conducting M&A commercial due diligence, companies are advised to leverage different software products that simplify the procedure and make it more efficient.

Tech’s role in streamlining commercial due diligence

The most popular software used by companies for commercial due diligence purposes is a virtual data room (VDR). A VDR is a secure online repository where users can store, share, and collaborate on confidential business information. Let’s explore its functionality:

- Access security. Features like granular user permissions and two-factor authentication give full control over who can access the documents, preventing data leakage.

- Document security. Features like redaction, watermarks, and granular document permissions protect confidential data from unauthorized access and ensure an additional layer of security during the due diligence process.

- Collaboration. Features like Q&A sections, notifications, annotations, and comments enable effective communication among stakeholders.

- Analytics. Full audit trails, activity dashboards, and reports allow data room administrators to track user behavior and see what’s happening in a data room. This ensures data-driven decisions.

- Mobile accessibility. Many providers offer mobile apps, allowing users to access documents and collaborate on the go.

| You can learn more about M&A due diligence software in our article. It’ll give you insights into how to choose the right provider. |

In turn, here you can quickly familiarize yourself with the Top-5 VDR providers and the availability of important risk-mitigating features.

iDeals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Key takeaways

Let’s summarize:

- Commercial due diligence is a thorough evaluation of a target company’s commercial viability conducted before making an investment decision. Its primary goal is to provide prospective buyers with a deeper understanding of the potential and risks of the transaction.

- The commercial due diligence process involves market analysis, customer relations, competitive landscape, financials, operations, and sales and marketing strategies.

- The key strategies to follow are seeking advisory services, allocating sufficient time, creating a comprehensive report, and leveraging technology.

- A virtual data room is a digital solution to simplify and streamline commercial due diligence by providing a secure online platform for storing, sharing, and collaborating on confidential business information.

Thorough preparation for due diligence is crucial as it lays the foundation for informed decision-making. Ensure you prioritize it.

Category

Due diligenceFAQ

Using technology, like a virtual data room, significantly accelerates, simplifies, and enhances the commercial due diligence process. It allows users to share and collaborate on critical information securely and easily due to features like granular access controls, Q&A sections, annotations, and analytics.

The duration of commercial due diligence varies depending on the complexity of the deal and can range from a few weeks to several months.

Commercial due diligence is typically conducted by private equity firms, strategic buyers, consulting firms, and other stakeholders involved in mergers, acquisitions, or investments to make informed decisions.